[News Space=Reporter seungwon lee] Among the major Asian stock markets this year, Taiwan ranked first with remarkable strength. On the other hand, the Korean stock market, represented by KOSPI and KOSDAQ, showed the lowest rate of return.

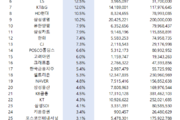

The US broadcast CNBC reported on the 23rd (local time) that the Taiwan Straits Times Index rose 28.85% this year, the largest increase among 11 major Asia-Pacific stock indices. Following the Straits Times Index, the Hong Kong Hang Seng Index (+16.63%), Singapore Straits Times Stock Exchange (+15.78%), Japan Nikkei 225 Stock Average (15.65%), and China CSI 300 Index (+14.64%) also recorded increases in the 10% range.

It was followed by Malaysia's KLCI up 9.73%, India's Nifty 50 up 9.28%, India's BSE Sensex up 8.69%, and Australia's ASX 200 up 8.05%.

On the other hand, KOSPI fell by 8.03% this year. Among the 11 Asian countries' indices, only Malaysia's Jakarta Composite Index (-2.42%) and KOSPI (-8.03%) fell this year.

Even among the 87 Asia-Pacific stock indices compiled by Bloomberg, KOSPI’s performance this year is only 76th. The last, at 87th, is KOSDAQ, which plunged 21.62% this year.

Earlier, on December 7, Bloomberg evaluated that "the gap in market capitalization between the Korean and Taiwanese stock markets has widened to $950 billion (approximately 1,352 trillion won), and that Korea's economic situation stands in contrast to that of its 'tech rival' Taiwan, which is riding the global artificial intelligence (AI) boom."

The stock price of TSMC, the world's largest foundry (semiconductor contract manufacturing) company accounting for 38% of the Taiwanese stock market cap, has risen 82.1% this year, leading the Taiwanese stock market. On the other hand, the stock price of Samsung Electronics, the No. 1 domestic market cap, has fallen about 31.8% this year as it has fallen behind in the competition in the high-bandwidth memory (HBM) sector, a key product in the AI sector.

CNBC in the U.S. said, "This year, the Korean government's value-up policy appears to have failed to boost stock prices," and added, "Uncertainty has been added due to domestic political turmoil, such as U.S. President-elect Donald Trump's tariff pledges and martial law."

Paul Kim of Eastspring Asset Management said, “The U.S. and China are expected to have a major impact on the export-driven Korean economy,” adding, “Major exporters such as information technology (IT) hardware and automobiles are likely to face difficulties.”

DBS Bank forecasted in its report that demand for AI mobile phones, PCs, and other home appliances will increase next year. The global semiconductor sector pointed out that the expansion cycle usually lasts 30 months, and forecasted that the current cycle, which started in September 2023, will continue until the end of next year.