![Lee Jae-yong, Chairman of Samsung Group [Samsung Electronics] Lee Jae-yong, Chairman of Samsung Group [Samsung Electronics]](/data/photos/202305/704_683_1659.png)

[NewsSpace=JeongYoung Kim] It has been argued that Korea's inheritance tax is excessively high compared to major foreign countries. In the case of Samsung, the inheritance tax of Samsung Electronics Vice Chairman Lee Jae-yong and other owner families was around 12 trillion won after the death of the late chairman Lee Kun-hee.

The Korea Economic Research Institute (KERI) revealed this on the 11th through a report titled "Issues and Improvement Directions of the Current Corporate Succession Inheritance Tax System."

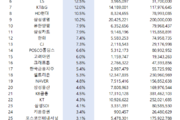

KERI pointed out that as of 2021, the proportion of inheritance and gift tax revenue to GDP was the highest among OECD member countries (South Korea, France, and Belgium), indicating an excessive level. The proportion, which was 0.5% in 2020 (ranked 3rd), increased by 0.2 percentage points in 2021.

Although the top inheritance tax rate (50%) for direct lineal descendants is the second highest among OECD member countries, following Japan (55%), when inheriting stocks from major shareholders, an augmented valuation (20% increase) is applied for taxation. This results in a maximum tax rate of 60% when applying the increased taxation on shares of the controlling shareholder.

Lim Dong-won, a researcher at the institute, argued, "Only Korea conducts a uniform premium evaluation on the largest shareholder, which violates the principle of real taxation under the tax law in that management premium is already included in stocks."

In particular, "Inheritance tax in the case of corporate succession is a tax that occurs only in the process of transferring the inherited's property to the heir for free without changing the company's actual body," he said, "It is acting as the biggest obstacle to corporate succession."

KERI also pointed out the limitations of the recent government reform proposal for inheritance taxes, which suggested a transition to inheritance acquisition tax and an increase in the deduction amount as a means to promote corporate succession.

Furthermore, KERI proposed that in order to eliminate the obstacle factor of "punitive inheritance tax" during corporate succession, it is necessary to first reduce the inheritance tax rate and then introduce capital gains taxation for corporate succession in the future, enabling a smooth transition of corporate ownership.